Although markets have rebounded we can take little encouragement from corporate results. So far they are better than expected, but this is largely because expectations were set so low. Profits are below the level of a year ago and the corporate sector continues to spend cashflow on the buyback of their own shares.

A number of factors weighed on the corporate sector in 2015 as weakness in global growth depressed sales, a strong dollar hit firms with overseas sales and the falling oil price detracted from energy and related companies. Cyclical sectors delivered weak results while defensives provided a haven.

The bar has been set low

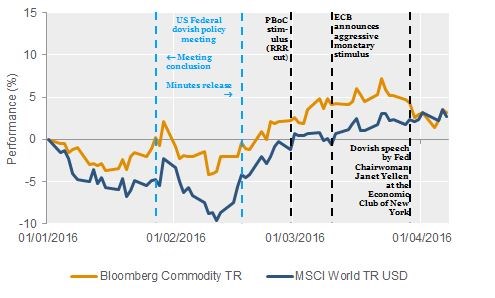

Heading into the current earnings season, expectations were significantly depressed. Meanwhile the expected path of US interest rates followed a dovish course in Q1 and the dollar’s subsequent reversal can be expected to aid firms with international sales. The oil price recovered from a low base with Brent Crude up almost 20%.

With more than a fifth of S&P 500 companies having reported, 82% have beaten earnings expectations and 59% beaten revenue estimates.* In Europe, euro strength may have weighed on earnings for some companies and the strength of the yen can be expected to provide a significant headwind to Japanese firms.

Equity markets in Q1- weakness in January and February followed by a strong recovery as risks receded

Source: Lipper

Corporate barometer

Forecast sales growth remains muted although positive for 2016, whilst there have been significant downward revisions to expectations. The season has been punctuated by disappointments from IT and telecoms companies including Alphabet, Microsoft, Apple and Verizon.

Similarly bellwether Caterpillar disappointed expectations for sales and earnings. Within financials, banks were notable with revenues and earnings much lower – although firms were generally able to cut costs by a greater than expected margin which provided positive surprise.

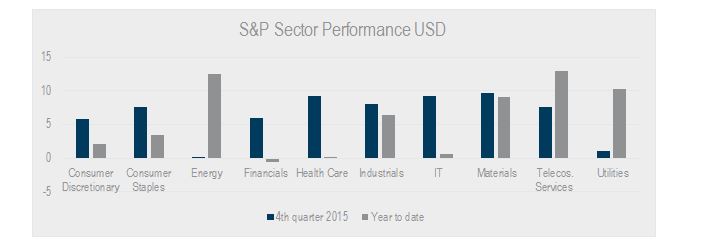

Energy, industrials and materials lead the market

Following some of the worst revisions to analysts’ earnings expectations, energy, materials and industrials performed strongly in the year to date. In 2016 telecom services and utilities have also performed well. This has also been played out in the outperformance of value vs growth styles where more cyclical stocks make up the value component. The weakest sectors include financials (where banks have been impacted by concerns over margins in low and negative rates), healthcare, consumer stocks and IT.

Source Lipper as at 22 April 2016

Conclusions- difficult outlook

Company sales and earnings illustrate the challenges posed by weak global growth. Consensus earnings put the S&P 500 on a forward PE of 17 and Europe on 15x. Valuations are supported by low interest rates (which underpin low discount rates), but we do not see significant potential for rerating, while growth potential is muted and wage inflation poses a risk to profitability.

Investors have pulled back from equity markets, with significant outflows from mutual funds and ETFs. Meanwhile the corporate sector continues to pick up slack through stock buybacks, with Goldman Sachs forecasting that this will increase to US$600 billion in the US in 2016 – a figure equivalent to forecast corporate spending on capex.

Our portfolios

Our portfolios remain defensively positioned following our de-risking largely in 2015, and we are currently carrying a higher than usual allocation to cash. We did not reduce equity exposure further because of the short-term potential for markets to rebound.

Sources

Goldman Sachs, US Weekly Kickstart, 22 April 2016

Deutsche Bank, Early morning Reid – macro strategy, 22 April 2016

Disclaimer

This article was previously published on Tilney prior to the launch of Evelyn Partners.