The deposit interest rate has been cut deeper into negative territory and the asset purchase programme increased in terms of size and scope, which could provide a short-term boost to Eurozone equities. In a broader context, however, the whole credibility of Quantitative Easing (QE) as a tool to promote economic growth is being brought into question, seven years after the US Federal Reserve started the current experiment.

In December last year, the ECB responded to concerns around the weakness in inflation and economic growth in the Eurozone by injecting fresh stimulus. However, having signalled their intention ahead of time, the market was underwhelmed by what was delivered, leading to what many are now calling ‘Draghi’s Disappointment’. If anything, these concerns have intensified at the start of this year, and the messaging out of the ECB has clearly suggested more action on the way. As a result, the pressure was on for Draghi to deliver. In this he certainly exceeded market expectations, but we find ourselves increasingly questioning the credibility of Central banks and the efficacy of these unconventional monetary policy measures.

What happened?

The ECB had a range of possible options in terms of further stimulus, and in the event it essentially moved on all fronts, cutting interest rates and expanding its asset purchase programme (QE) along with some smaller additional measures. On interest rates, the ECB cut the key interest rate another 0.1% to -0.4% largely in line with expectations. This represents a further foray into another monetary policy experiment, this time around negative interest rate policies (NIRPs).

The main surprise came in the changes to the QE programme, which was previously extended in its duration – it will now last until at least March 2017. The market had expected an increase of €10 billion per month, but Draghi instead went further by increasing the level of purchases by €20 billion to €80 billion per month. At the same time, the ECB President also surprised markets by expanding the scope of the purchase programme to include non-banking corporate bonds in addition to the government bonds that were already in scope, together with some more minor changes. All of this amounted to a more significant stimulus than was generally expected. Although we continue to have reservations about the economic impact of QE, this action certainly wasn’t another disappointment.

Why they did it

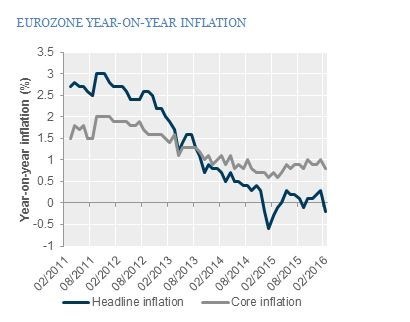

As discussed in previous notes, the ECB’s key mandate is to ensure price stability and inflation at, but just below, 2%, which is generally considered the desirable level for a solid and healthy economy. Although there is no specific mandate to promote economic growth, the ECB has been clear that it sees these stimulus measures as helping improve the provision of credit, which should help encourage growth – and that, in turn, will accelerate inflation back towards its target. As the chart below shows, inflation is a long way below target, with the most recent reading in February showing the headline measure was back in deflation. Even stripping out the volatile and external factors of energy and food shows core inflation is weak, and this is a major reason the ECB chose to take fresh action.

Source: Factset, headline inflation is harmonised CPI inflation, core inflation is harmonised CPI inflation excluding fuel and unprocessed foods

Our view

Although this policy action went further than expected, our concern is that QE as a policy does not, in and of itself, promote the economic recovery that is needed in the Eurozone, although it could certainly help support risk asset prices in the short-term. In previous comments the ECB has recognised that fiscal policy must work in tandem with monetary policy to promote such growth, but there remains significant reluctance by governments in the Eurozone to take the action required.

What the Eurozone economy really needs is much greater structural reform, fiscal stimulus and a re-capitalisation of the banks to promote a healthier economic recovery with a properly functioning banking system to support it. That is a long way from what we have now.

More broadly, we think that more and more market participants are coming around to our way of thinking: that QE alone is not the economic panacea that many believe it is, and that there is a serious risk that Central banks lose credibility in the eyes of the market.

Conclusion

Mario Draghi may have restored respect from the markets in the short-term with this better-than-expected package, but the issues are more widespread as the economic credibility of the entire QE policy comes into question.

The move could well boost Eurozone equity in the short term, and put some downward pressure on the currency – though for sterling investors Brexit issues mean hedging euro exposure is not as obvious a trade as it may have been in the past.

In the medium term, however, Central banks look like they’re running out of policy tools, even of the unconventional variety, and this could be the last roll of the dice before markets call time.

We remain cautiously positioned in our portfolios, favouring alternative asset classes and tactical cash over equities and bonds. Within equities, we have been favouring Eurozone equities – bearing in mind the boost QE can provide to assets if not economies – and we will continue to monitor the investment outlook carefully, making any changes as needed.

If you have any questions about this or your investments in general, please call us on 020 7189 2400, request a call back or email us at best@bestinvest.co.uk and someone will be in touch with you as soon as possible.

Disclaimer

This article was previously published on Tilney prior to the launch of Evelyn Partners.