Facing a deteriorating economic outlook, the Bank of England went slightly further than market expectations with its stimulus package. However, with more substantial challenges to the global economy ahead, and with unconventional monetary policy largely discredited, it is unlikely that today’s action alone will have a material impact. Our house view remains that portfolios should be cautiously positioned in equities and bonds, with increased exposure to alternative assets such as absolute return funds and physical gold.

In an effort to support the UK amid a deteriorating economic backdrop, the Bank of England’s Monetary Policy Committee (MPC) has introduced a package of monetary stimulus measures, largely in line with what markets expected. While the direct impact of these measures is likely to be limited, it represents a stark change of policy direction, considering markets were contemplating interest rate hikes this time last year.

What happened?

The MPC held off acting during its first post-Brexit meeting in July, in order to give itself time to digest the economic and market consequences of the result. That made the August meeting a dead-cert for monetary policy loosening, and the Bank of England took a two-pronged approach, cutting interest rates and restarting its Quantitative Easing (QE) asset purchase programme. It cut the base interest rate by unanimous agreement from 0.5% to 0.25%, in line with expectations, and it introduced a Term Funding Scheme (TFS), which aims to help ensure this rate cut is passed through to the real economy.

Restarting QE was more controversial, with the measure agreed by a margin of 6-3. Another £60 billion of assets will be added to the Central bank’s balance sheet, bringing the total stock held to £435 billion. Following the lead from the European Central Bank, the scope of the programme will also be expanded to include corporate bonds (up to an additional £10 billion worth). Together, these measures are aimed at creating a coherent support package. This could continue to provide support to risk asset markets, though it’s difficult to see it providing much of a boost to the underlying economy on its own.

Why did they do it?

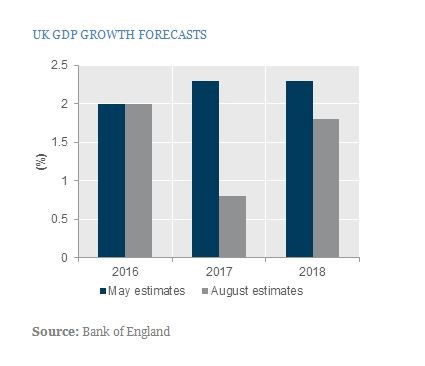

Ahead of the UK’s EU referendum, the Bank of England, along with economists on both sides of the debate, expected that a Leave result would give rise to an initial hit to UK GDP, and that forecast remains the Bank’s core scenario. Although the downward revision of 2% over the next three years is the largest in recent memory, it falls short of forecasting a recession. This seems to be borne out by recent survey data, which show firms expecting a sharp slowdown for the next twelve months following relatively upbeat data in the first half of the year. Facing the prospect of an immediate slowdown in business investment, followed by weakness in consumer spending and employment, the MPC acted to head off a more serious impact with this stimulus package.

Our view

The stimulus package today was largely expected by markets, though some of the details – particularly restarting QE and including corporate bonds – were effectively a ‘bonus’. We remain concerned that QE is a discredited policy in terms of its ability to stimulate economies rather than just risk assets. At best, this could lead to diminishing marginal returns and ever-shorter stimulus rallies. At worst, it could drive a market rout as some level of rationality creeps back in. While the introduction of TFS is interesting, insofar as it directly addresses a problem we’ve highlighted before (banks are themselves the blockage in the monetary policy transmission mechanism), the materiality of the move is still highly questionable.

This monetary policy easing is likely to be the start of a coordinated stimulus response, which will probably include fiscal stimulus from the Government, as well as further monetary easing. It is quite possible that this dual-policy approach could succeed where monetary policy alone has failed, though it would involve softening the Government’s austerity stance somewhat. Interestingly, the Bank of England’s Governor, Mark Carney, was very clear in the press conference that the lower bound for interest rates was slightly above zero. He effectively ruled out negative interest rates in the UK, a similar view to that held by the US Federal Reserve. Instead, further easing is likely to come from another cut in interest rates to just above zero, as well as an expansion of QE in size and scope.

A challenging outlook

While the Brexit vote is not itself a cause of the problems in the global economy, it has acted as a catalyst to bring forward the onset of an economic downturn in the UK. Today’s stimulus measures have therefore been widely expected and are likely to be the start of a coordinated monetary and fiscal policy response. While this may provide temporary support to asset prices, it does not address the wider challenges to the global economy. We cover these in our regular updates and we remain concerned over the valuations of traditional asset classes.

In light of this, our portfolios remain positioned for a challenging economic outlook, favouring defensive exposure within our equity and fixed income allocations, and we are increasing our holdings in alternative assets such as absolute return funds and physical gold holdings.

If you would like to discuss this, or have any questions about your investments, please call 020 7189 9999.

Disclaimer

This article was previously published on Tilney prior to the launch of Evelyn Partners.