European competition not impacting UK confidence

Business is booming, despite Brexit uncertainty, according to entrepreneurs and scale-up leaders.

An update on our separation

Professional Services will now be known as S&W. Find out more.

Business is booming, despite Brexit uncertainty, according to entrepreneurs and scale-up leaders.

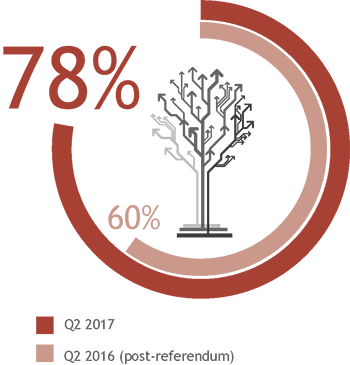

Business is booming, despite Brexit uncertainty, according to entrepreneurs and scale-up leaders. Nearly 80% of respondents are planning for growth over the next twelve months, despite the looming March deadline.

81% of our respondents say that they weren’t affected by the Article 50 uncertainty, demonstrating the ongoing resilience, and confidence, of the UK entrepreneur.Nick Travis

The immediate reaction, following the EU referendum vote, was a massive depreciation in the value of the pound. Larger businesses tend to hedge out risk, and therefore are less effected by currency fluctuations, but smaller businesses, who are less likely to hedge out currency risk are much exposed to the both the negative and positive risks of currency fluctuations.

Increasingly, smaller businesses are now international and so have income and expenditure in several currencies.

It was feared that investment would begin to dry up as the market declined. However, while business owners and investors may be slightly less confident they are still, by and large, eager to see what the future will bring. The UK offers an ideal situation to begin a business and scale a business:

GMT allows business to trade and communicate easily across the world

The rule of law remains paramount

There are a number of tax efficient savings to assist in growing a business

There is a developed professional sector to support a business

There is access to a huge supply of technically proficient individuals

All the above factors, which make the UK a great place to start a business, also make it ideal for businesses seeking investment.

The other, less heralded, issue with leaving the EU was its potential tarnishing of Britain as a place to do business - and the injection of confidence to other capital cities who may find themselves more able to compete with London.

Paris has recently launched Station F, a centre dedicated to start-ups, Berlin is looking to attract finance and a host of other European cities now seek to interest the highly-skilled workforce that is a requirement for all scale-up businesses.

However, what has become apparent is that few of these cities lack the rounded appeal the UK offers.

The social aspects of the UK, such as schooling, culture, law, among others, are still ahead of its European counterparts - while the infrastructure available to those starting and scaling-up in the UK remains second to none.

Indeed our respondent’s confidence in their own prospects over the next year is only likely to increase.

The social aspects of the UK, such as schooling, culture, law, among others, are still ahead of its European counterparts - while the infrastructure available to those starting and scaling-up in the UK remains second to none. Indeed our respondent’s confidence in their own prospects over the next year is only likely to increase.Nick Travis

The UK scale-up market is flourishing, partly due to the external finance available to many within the sector. From angel investors to private equity, there are advantages in getting scale-up investment from the UK.

The number of private equity deals has been steadily increasing in recent years. Arguably, if Brexit was an issue in the UK market then businesses looking to raise external finance would find it a lot harder than they are currently.

There have been several Series A to C investments (the different rounds of investment that a business goes through) into scale-up companies in the UK in recent months. As these represent a confidence in a company’s long term growth, it is hard to argue that investment is shying away from backing the UK as a place to grow a business.

It is generally sensible for an entrepreneur to at least consider “de-risking” their personal position by taking some cash out of a business as part of a private equity deal.

This allows them to begin solidifying their financial position while still having a significant proportion of their work personal capital aligned with the success of the business.

A few years ago, the trend was for an entrepreneur to sell the business entirely and start again. However, following the course of fast-growth businesses in the US, we’re now seeing a noticeable shift to individuals remaining committed to scaling-up their business by either retaining senior positions or large equity stakes.

DISCLAIMER

By necessity, this briefing can only provide a short overview and it is essential to seek professional advice before applying the contents of this article. This briefing does not constitute advice nor a recommendation relating to the acquisition or disposal of investments. No responsibility can be taken for any loss arising from action taken or refrained from on the basis of this publication. Details correct at time of writing.

This article was previously published prior to the launch of Evelyn Partners.

Some of our Financial Services calls are recorded for regulatory and other purposes. Find out more about how we use your personal information in our privacy notice.

Your form has been submitted and a member of our team will get back to you as soon as possible.

Please complete this form and let us know in ‘Your Comments’ below, which areas are of primary interest. One of our experts will then call you at a convenient time.

*Your personal data will be processed by Evelyn Partners to send you emails with News Events and services in accordance with our Privacy Policy. You can unsubscribe at any time.

Your form has been successfully submitted a member of our team will get back to you as soon as possible.