With lockdown life easing back to normality, there are tentative signs of a new business cycle emerging. As such, global equities rose 19% in the second quarter, the strongest rally for 11 years, a 72% retracement of the prior falls since COVID-191. Markets are discounting a new business cycle, with consumers spending in the shops again following the easing of restrictions. For instance, UK underlying real retail sales (excluding auto fuel) rebounded by a record +10% in the month of May, after a -15% collapse in April2.

This business cycle could be extended beyond an initial bounce in growth as the pandemic was an exogenous event, rather than a domestic issue and global household liabilities have deleveraged since the Global Financial Crisis, essentially meaning lower relative debt levels. Moreover, central banks have stepped in, with major economies having seen historic levels of monetary and fiscal support at c.26% of GDP, which should boost the recovery3.

While we recognize that the sharp equity rally may overshoot still weak underlying macroeconomic fundamentals, the broad success of central banks in suppressing market volatility since the end of March has shown a Pavlovian willingness in investors to follow monetary and fiscal stimulus. From here, the upward trajectory of stocks will likely depend on the ebb and flow of news and crucially how our 4 key macro risks materialise.

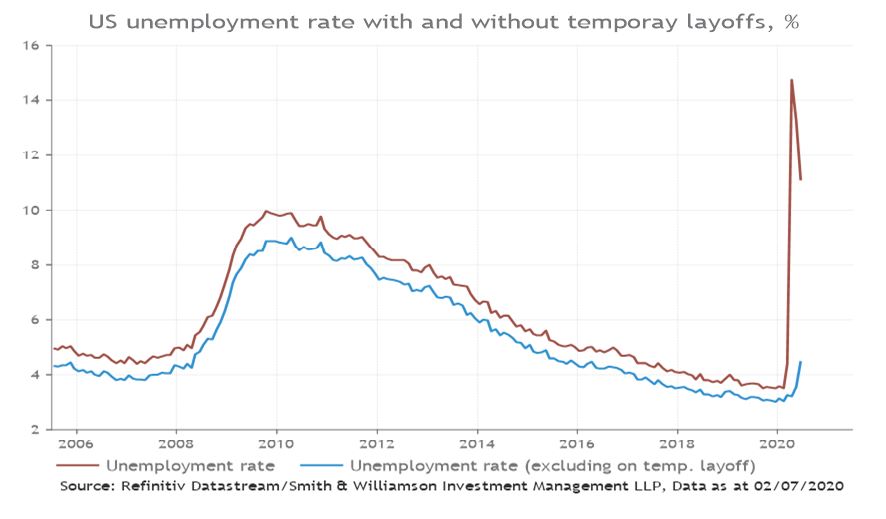

Risk #1: Jobs fail to come back after lockdowns are lifted and the recovery runs out of steam.

It is still early to make a judgement on labour markets, but some of the jobs data has been constructive. For example, the US June payroll report comfortably beat market expectations with a 4.8 million increase4. Around 40% of the jobs gains were in leisure and hospitality, a sector that has been heavily exposed to the brunt of the COVID-19 outbreak.

Though it remains to be seen if the bulk of workers return to jobs, enhanced unemployment benefit and stimulus cheques have given a significant boost to personal income. How fast these are phased out will be important. In May, US real take home pay grew by more than 8.3% from a year ago, the 3rd highest reading from available data that goes back to 1960. For now, this will give consumers the financial wherewithal to shop, providing the foundations for economic growth5.

Chart 1: The economic recovery runs out of steam

Source: Refinitiv Datastream/Smith & Williamson Investment Management LLP, Data as at 02/07/2020

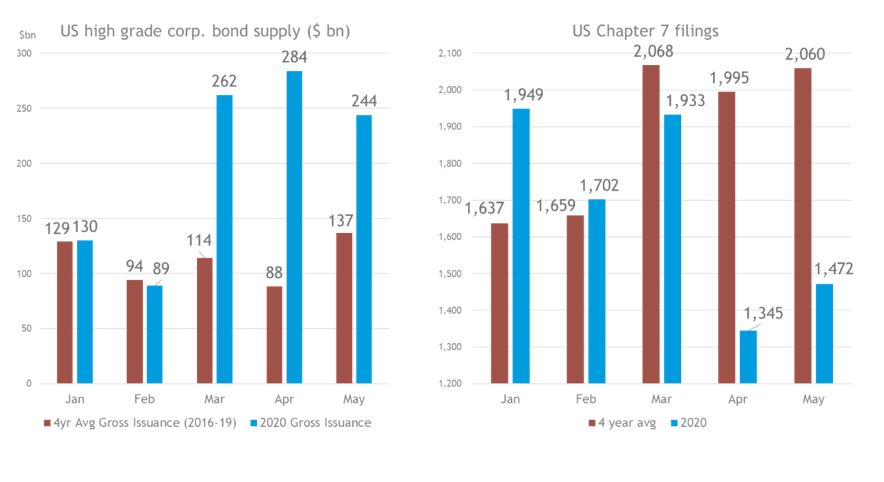

Risk #2: Elevated level of corporate liabilities raises solvency issues. As we discussed in the May Investment Outlook, the Fed’s explicit backstop of the US corporate credit market has enabled companies to issue record levels of bonds to meet immediate financing needs. This comes at a cost, as accumulating credit market liabilities on the balance sheet could make it difficult for firms to make future debt payments. Nevertheless, by enhancing its secondary market credit facility in mid-June to include individual corporate bond purchases (including riskier high yielding securities), the Fed has effectively become a regular market participant. This should lower the risk of near-term debt refinancing issues in credit markets but at the expense of raising long-term solvency issues.

Chart 2: Elevated level of corporate liabilities raises solvency issues

Source: Dealogic, J.P.Morgan/Smith & Williamson Investment Management LLP, Data as at 30/06/2020

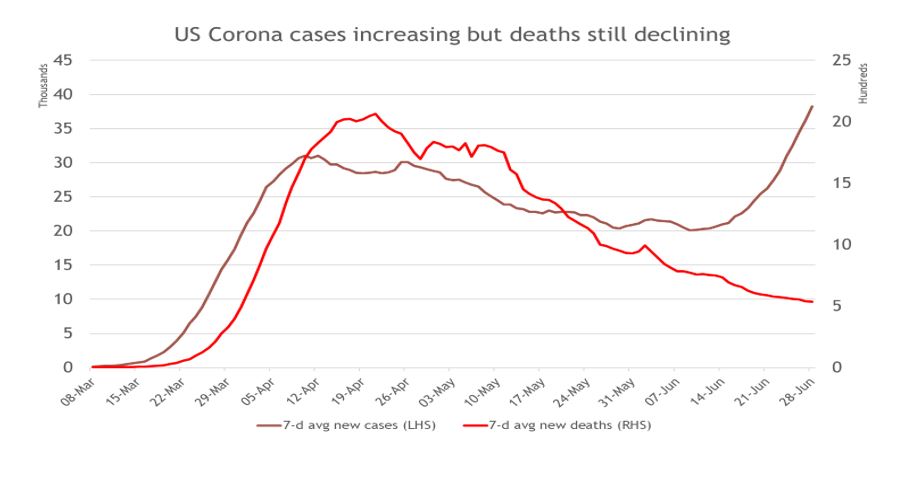

Risk #3: A renewed spike in COVID-19 related deaths or hospitalisations. History shows that there have been eight major pandemics since the early 1700s, of which seven had a significant peak around 6 months after the first peak6. As social distancing is relaxed and lockdowns are lifted, there has been a recent pick-up in COVID-19 cases in Beijing, Leicester in the UK and major US states, such as Texas, Florida and California. Though additional COVID-19 cases should probably be expected as more testing is conducted, global coronavirus related deaths and hospitalizations are trending down. The risk for markets is that further waves lead to widespread lockdowns again.

Chart 3: A renewed spike in COVID-19 related deaths/hospitalisations

Source: The Covid Tracking Project/Smith & Williamson Investment Management LLP, Data as at 29/06/2020

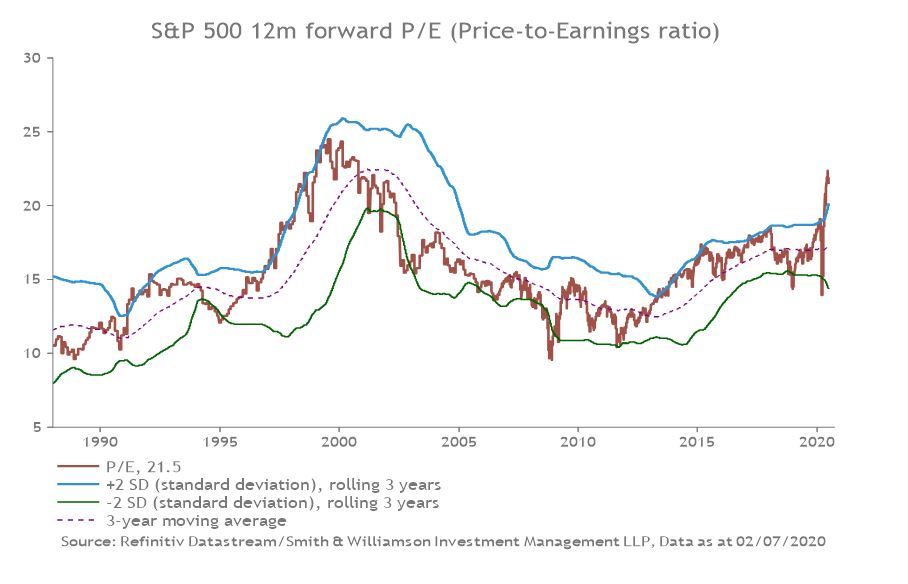

Risk #4: Some US equity valuations look toppy. The US S&P 500 stock market index is currently trading on a 12-month forward Price-to-Earnings ratio of 22x, not too far off the peak of 24x during the “dot com” bubble two decades ago7. Valuations could become even more extreme should company earnings fail to recover. If Joe Biden wins the keys to the White House on 3 November his agenda is to reverse much of the Trump tax cuts, which we estimate could halve consensus 2021 Earnings Per Share (EPS) growth expectations of now around 30%. Lower EPS growth could crystalize investor concerns over valuations and the durability of the equity rally.

Chart 4: Some US equity valuations look toppy

Source: Refinitiv Datastream/Smith & Williamson Investment Management LLP, Data as at 30/06/2020

Given the disproportionate impact of COVID-19 on lower-income households, combined with high unemployment rates, continued accommodative policy support is likely to be necessary. With so much economic uncertainty, including a host of political and geopolitical risks, the recovery is unlikely to be smooth sailing. However, on balance, we believe ongoing central bank and government support should mitigate macro risks in the second half of 2020 to provide uplift for equities.

Sources:

- MSCI All Country World Index/ Smith and Williamson Investment Management, 29/06/2020

- Refinitiv Datastream/ Smith and Williamson Investment Management, 30/06/2020

- BOA, IMF, OECD, 29/06/2020

- Refinitiv Datastream/ Smith and Williamson Investment Management, 30/06/2020

- Refinitiv Datastream/ Smith and Williamson Investment Management, 30/06/2020

- The future of the COVID-19 Pandemic: Lessons Learned from Pandemic Influenza

- Refinitiv Datastream, data as at 30 June 2020

- The Covid Tracking Project/Smith & Williamson Investment Management LLP, 29/06/2020

- Refinitiv Datastream/ Smith and Williamson Investment Management, 30/06/2020

DISCLAIMER

By necessity, this briefing can only provide a short overview and it is essential to seek professional advice before applying the contents of this article. This briefing does not constitute advice nor a recommendation relating to the acquisition or disposal of investments. While considerable care was taken to ensure the information contained within this article was accurate and up to date at the time of publication, no warranty is given as to the accuracy or completeness of the information. No liability is accepted for any errors or omissions in such information, or any action or inaction taken on the basis of this publication.

Please remember investment involves risk. The value of investments and the income from them can fall as well as rise and investors may not receive back the original amount invested. Past performance is not a guide to future performance.

Evelyn Partners Investment Management LLP

Authorised and regulated by the Financial Conduct Authority.

Registered in England No. OC 369632. FRN: 580531

Evelyn Partners Investment Management LLP is part of the Evelyn Partners group.

© Evelyn Partners Group Limited 2021

Ref: 95820eb

Disclaimer

This article was previously published prior to the launch of Evelyn Partners.