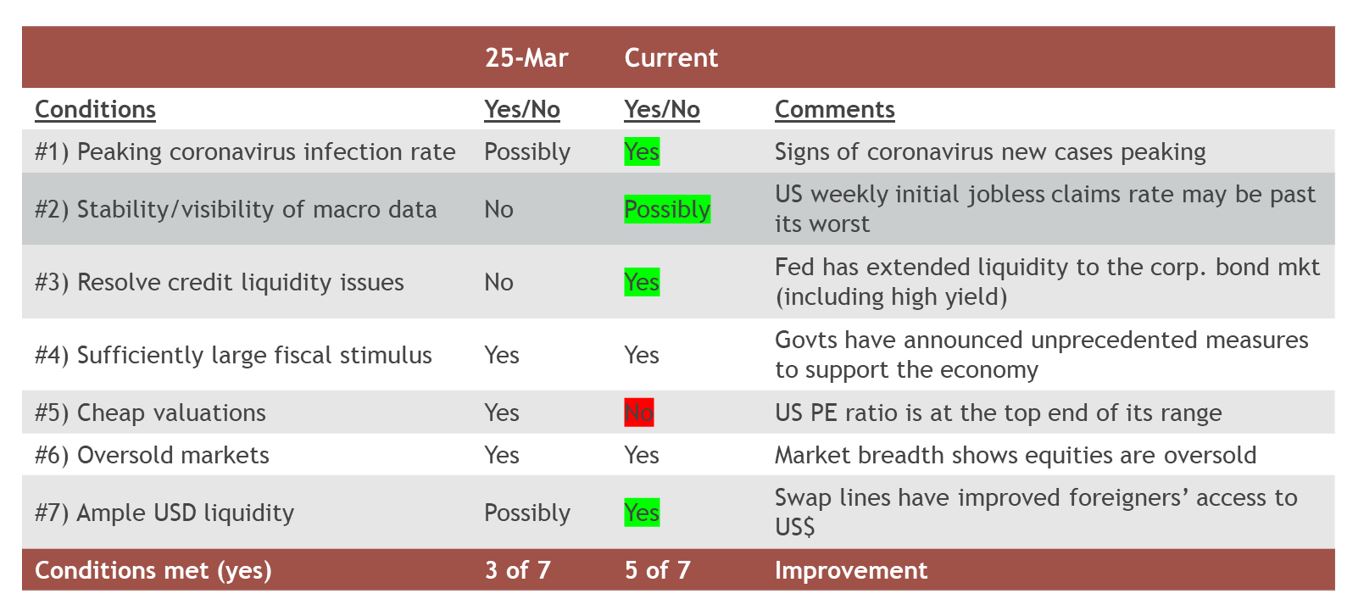

Following on from our review at the end of March, we make a qualitative assessment of the 7 conditions we believe are necessary to stabilise equity markets. In short, we believe that 5 of these 7 conditions may be being met, versus 3 in our report late last month, as shown in Table 1.

Table 1: Summary of the conditions necessary to stabilise equity markets

The 5 conditions that point to stabilising markets include; 1) peaking coronavirus infection rates; 2) resolving credit issues; 3) ample dollar liquidity; 4) sufficiently large fiscal stimulus and; 5) oversold markets. Conditions from 1-3 have shown an improvement since late March, while 4 and 5 are unchanged since late March.

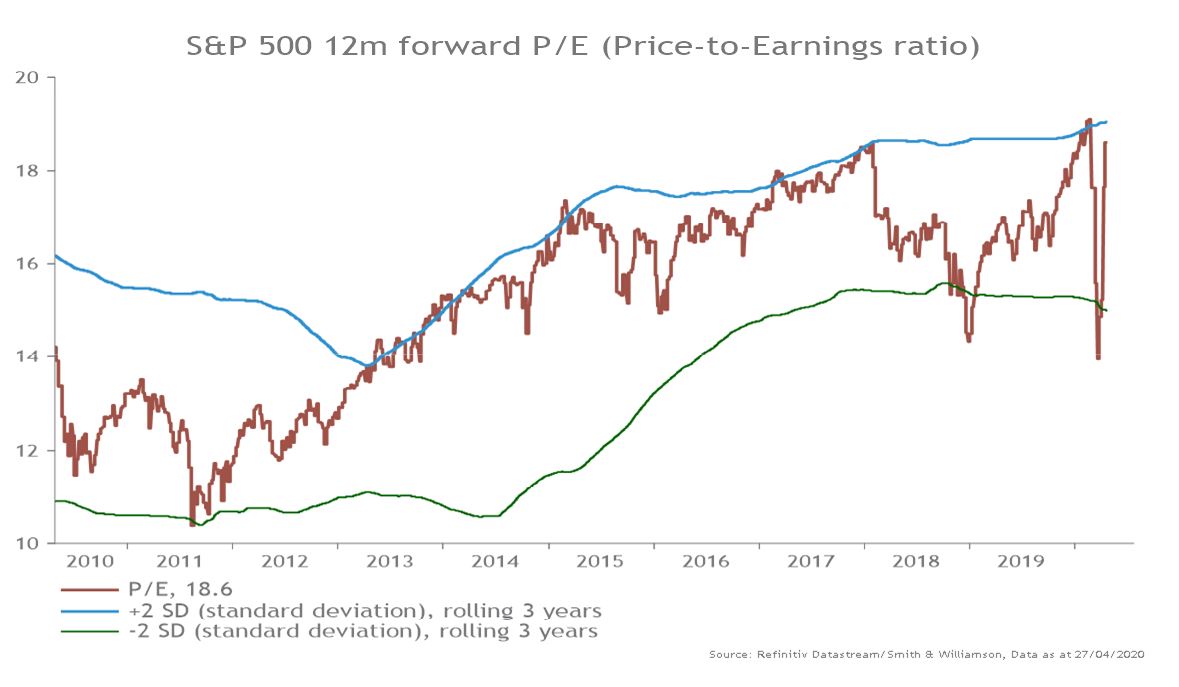

However, one condition (valuations) has deteriorated, as evidenced by the US Price-to-Earnings ratio moving up to the high end of its 3-year trading range. We see the remaining condition (stability/visibility of macro data) shows possible improvement in the last month, but the message is still ambiguous.

In the section below, we discuss how each condition has changed or not.

#1) Peaking coronavirus infection rate? Yes: There are tentative signs that rates of new coronavirus cases are peaking across the world. From just over 100,000 new daily cases globally at the beginning of April, after some fluctuation, this number has decelerated to around 75,000.1 Data from Europe suggests that many of the worst affected countries are beginning to see their ‘curves’ flattening’. Italy, Spain, Germany and France have reported a decrease in the growth rate of new coronavirus cases. However, the US has over 800,000 active cases, with signs of social unrest over the continued lockdown. Until there is a clear exit strategy from the lockdown, the business outlook remains uncertain and this will make markets jittery. Nevertheless, on balance, peaking infection rates are supportive for markets.

#2) Stability/visibility of macro data? Possibly: China saw its real GDP decrease -6.8% in the first quarter, setting a potentially worrying precedent as the first major economy to release output data.2 However, high frequency statistics, like US initial jobless claims, suggest there may be light at the end of the tunnel. After peaking at a record 6.9m at the end of March, those US workers filing for unemployment benefit have fallen for the third consecutive week to a still very large 4.4m.3 This is important because historic data suggests that (in the US) jobless claims have peaked between 4-5 weeks after markets have ‘bottomed out’. With markets reaching lows on the 23 March, nearly 5 weeks ago and jobless claims falling this week, we could start to see some stability and importantly, visibility in future macro data. However, the cumulative new US jobless claims now exceed 26m, which may introduce second order effects. Moreover, they are just one data series and not representative of the world economy. In particular, the IMF’s latest economic projections see a 3% decline in global GDP, which would be the worst year since the Great Depression in 1929.4 That said, a reduction in new jobless claims is an important step in the right direction.

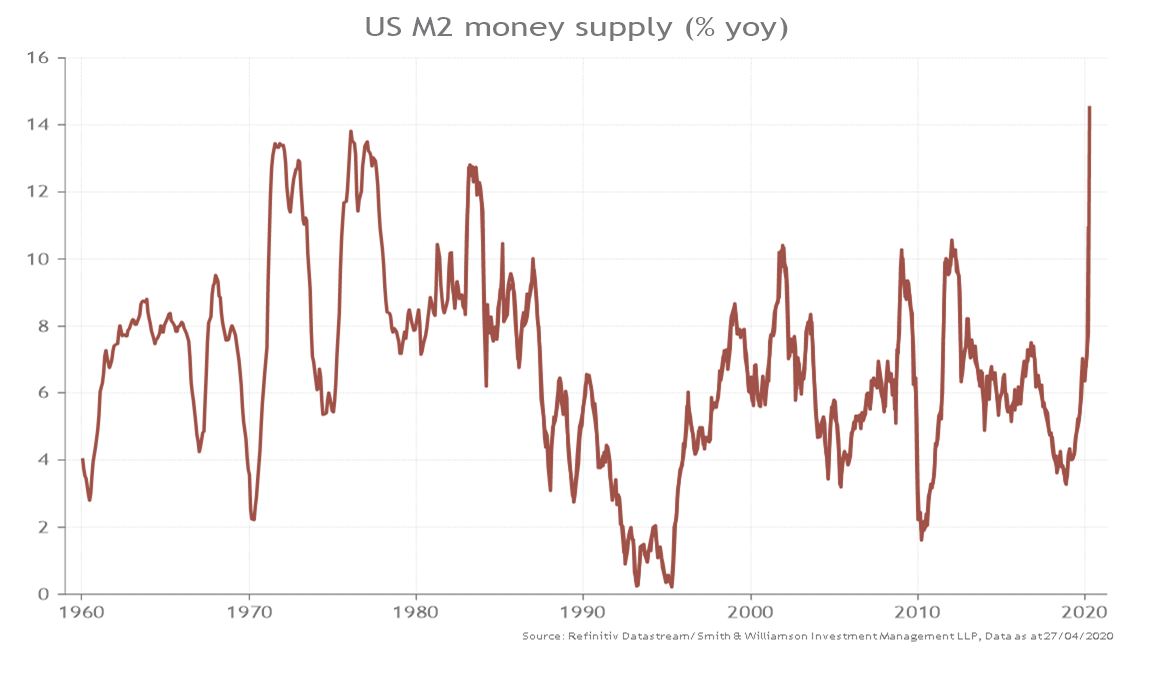

#3) Resolving credit liquidity issues in markets? Yes: To alleviate illiquidity in markets, the Fed (and other central banks) stepped-up their asset purchases (Quantitative Easing) and governments around the world unveiled large stimulus programs. Crucially, governments and central banks are working together to ensure funding flows to the private sector during the lockdown. For example, the $2.3trn US Coronavirus, Aid, Relief, and Economic Security Act (the ’CARES’ Act) stimulus package includes unprecedented Treasury-Federal Reserve co-operation. Essentially, the Treasury will allocate $454bn to the Fed who can multiply this capital by up to 10 times to provide credit worth around $4.5trn for firms, municipalities and funding support for the corporate bond market. This ‘state capitalism’ of injecting money into the economy, and where the US Treasury (i.e. taxpayers) absorbs future losses from potential non-performing private sector loans, has ensured there is ample liquidity flowing through the financial system. Indeed, US broad M2 money supply (e.g. currency in circulation and bank deposits), a rough proxy of the stock of money in the financial system, is expanding by over 14% a year, the fastest pace since World War 2, as seen in Chart 1. The hope is that largesse also helps support other credit markets too.

Chart 1: US broad money supply growth (% change from a year ago)

Source: Refinitiv Datastream/Smith & Williamson Investment Management LLP, as at 23 April 2020

#4) Sufficiently large fiscal stimulus? Yes: So far this year, Germany leads the way in terms of fiscal stimulus to GDP, having injected an amount equivalent to 24.7% of its GDP5, followed by Spain on 19.5%. Furthermore, EU leaders are also meeting to try and agree upon an additional €2trn economic revival plan for the region. The UK’s stimulus amounts to 18.4% of GDP, mainly in the form of loan guarantees, and includes measures such as the coronavirus corporate financing facility and tax deferment schemes. The US fiscal aid package includes direct payments of up to $3,000 for millions of families, as a form of Universal Basic Income, accounting for 1.3% of GDP, the biggest share of the economy for major economies.6 Fiscal stimulus responses have been impressive globally, helping to support markets by giving (relative) stability and much needed relief to businesses and consumers.

#5) Less demanding equity valuations? No: Equities in the US S&P 500 index are now trading at 18.6x forecast earnings over the next 12 months7, which is close to its pre-COVID-19 crisis level and makes valuations look more demanding than they were a month ago (chart 2). This Price-to-Earnings (P/E) multiple has been driven up by rising equity prices and reduced company earnings’ projections. More downward revisions to corporate earnings could see equity valuations pushed higher than pre-crisis levels. Unless earnings expectations find a firm basis to increase, equity valuations are no longer a condition that supports market stability.

Chart 2: Price-to-Earning valuation of the US stock market

Source: Refinitiv Datastream/Smith & Williamson Investment Management LLP, as at 23 April 2020

#6) Oversold markets? Yes: Despite the rebound in prices, equity markets are still oversold. We consider a measure of market breadth, in this regard, the number of stocks rising relative to the number of stocks falling in an index. Currently, 12.5% of NYSE stocks are closing above their 200-day moving average, which is up from 3% last month, but continues to indicate that markets are oversold, decreasing the risk of further downside.8 Although we do recognise that the rally since the low of 23 March has been driven almost entirely by the largest 20 stocks, which are overbought. Any earnings disappointment for these companies is a risk that could see the market retest lows.

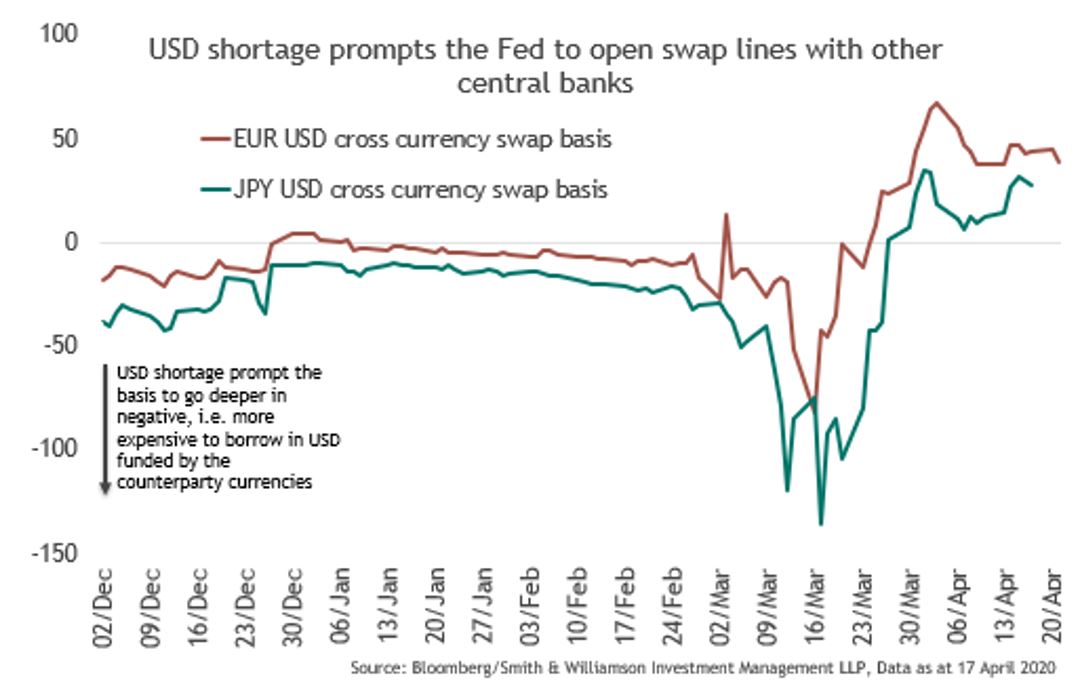

#7) Ample US$ liquidity? Yes: Investors are concerned that coronavirus-related market volatility will spill over to foreign exchange rates and that could restrict access to USD funding. To counter this risk, the Fed and five other major central banks, including the ECB, reactivated so-called swap lines in the middle of March and expanded access to another 9 other central banks a few days later. These swap lines allow central banks to temporarily borrow dollars from the Fed for an equivalent of local currency, which should ease concerns of a USD shortage. Since its peak on 16 March, dollar illiquidity (as measured by the so-called cross-currency basis swap, chart 3) has declined, in no small part thanks to the Fed. However, there is a risk that large borrowers with USD-denominated debt (e.g. China and other selected emerging markets) may still face USD funding shortages. Particularly if the already strong USD appreciates further from here.

Chart 3: Fed Swap facilities have reduced the shortage of US dollars overseas

Source: Refinitiv Datastream/Smith & Williamson Investment Management LLP, as at 16 April 2020

Overall, there has been an improvement in the economic conditions we monitor that we believe are required for markets to stabilise. On the upside, governments and central banks have taken steps to reduce credit risk and have launched impressive fiscal stimuli to support the private sector during lockdowns. Encouragingly, coronavirus infection rates seem to be peaking, Fed swap facilities have improved the availability of dollars outside the US and equity markets still look broadly oversold. On the downside, equity valuations are not inexpensive, and companies continue to downgrade their earnings estimates. The economic outlook still looks murky, though there are signs that the deterioration in US labour markets could improve over the coming months. On balance, the data is improving, which allows us to remain constructive on equities on a 12-month view, although risks remain.

Sources: All datapoints quoted from Refinitiv Datastream/ Smith and Williamson Investment Management LLP, data as of 21 April 2020

1 Bloomberg/Smith & Williamson Investment Management LLP, Data as at 23 April 2020

2 Refinitiv Datastream/ Smith and Williamson 21/04/2020

3 International Monetary Fund https://www.imf.org/en/Publications/WEO/Issues/2020/04/14/weo-april-2020

4 Refinitiv Datastream/ Smith and Williamson 21/04/2020

5 Liberum, US Department of Treasury, HM Treasury, European Commission 21/04/2020

6 Thomson Reuters https://www.reuters.com/article/us-health-coronavirus-usa-mnuchin/coronavirus-aid-bill-includes-3000-for-families-4-trillion-liquidity-for-fed-mnuchin-idUSKBN2190LL

7 Refinitiv Datastream/ Smith and Williamson 21/04/2020

8 Bloomberg/ Smith and Williamson 21/04/2020

DISCLAIMER

By necessity, this briefing can only provide a short overview and it is essential to seek professional advice before applying the contents of this article. This briefing does not constitute advice nor a recommendation relating to the acquisition or disposal of investments. While considerable care was taken to ensure the information contained within this article was accurate and up to date at the time of publication, no warranty is given as to the accuracy or completeness of the information. No liability is accepted for any errors or omissions in such information, or any action or inaction taken on the basis of this publication.

Please remember investment involves risk. The value of investments and the income from them can fall as well as rise and investors may not receive back the original amount invested. Past performance is not a guide to future performance.

Evelyn Partners Investment Management LLP

Authorised and regulated by the Financial Conduct Authority.

Registered in England No. OC 369632. FRN: 580531

Evelyn Partners Investment Management LLP is part of the Evelyn Partners group.

© Evelyn Partners Group Limited 2021

Ref: 61420lw

Disclaimer

This article was previously published prior to the launch of Evelyn Partners.