At the beginning of 2020 the attraction of having some gold exposure in portfolios seemed strong as central banks were once again ‘loosening’ policy and there was evidence of fiscal stimulus emerging too. This meant that there was downward pressure on interest rates and the cost of carrying for gold decreased in US dollar terms, that is to say the return that an investor foregoes in order to hold a non-income generating asset. Once again, the diversification benefits of gold could be effective within a multi asset portfolio, particularly when many other asset classes were beginning to look expensive.

Chart 1: Gold on average has a negative correlation to equities

Source: Bloomberg, calculations by S&W Investment Strategy, as at 10 April 2020

Roll forward a few weeks into the ‘eye’ of the market volatility surrounding the Covid-19 crisis and the presence of gold in portfolios was reassuring amongst the ensuing bedlam. Nevertheless, gold was dragged down along with other high quality assets such as US government bonds, principally due to the liquidity challenges being faced by many over-levered investors – it was one of the few assets that could be sold to meet other calls for funding. On a relative basis gold still significantly outperformed the S&P 500 by +24% from the beginning of the year (to 16th March) despite falling by -2.6% over that period, thus demonstrating its value in portfolio construction.

As the liquidity element of the crisis has calmed and markets have started to function more normally gold has resumed its positive trend reaching $1,745 per oz (as at 14th April). But what next for this hard asset that has an allure going back centuries? In our view it should still have a presence in portfolios due to the debasement of currencies and massive expansion of government & central bank balance sheets. To give some context, post the ‘Global Financial Crisis’ (GFC) in 2008 the Federal Reserve and commercial lending reached $1.2 trillion and today it has just hit $2.3 trillion and still rising (see chart 2). There is one important difference with what these funds are being used for. In 2008, they were used for the specific purpose of bailing out the banks, whereas today it is to help the real economy and getting money into peoples’ pockets to increase aggregate demand in the face of a potential liquidity trap (i.e. zero interest rates and a recession). This is otherwise known as ‘Helicopter’ money, a phrase coined by Milton Friedman in 1969, to describe such alternative monetary policies. These are unprecedented times and the desire to avoid a permanent deflationary trap such that Japan experienced in the 1990’s is very evident. It is interesting to note that inflation futures are beginning to edge higher in the US (see chart 3) with the gold price reflecting this changing dynamic. Gold will offer protection in real terms in this ensuing period and help preserve the purchasing power of money.

Chart 2: USD domestic creation

Source: Refinitiv Datastream, calculations by S&W Investment Strategy, as at 15 April 2020

Chart 3: US inflation futures are rising

Source: Refinitiv Datastream, calculations by S&W Investment Strategy, as at 15 April 2020

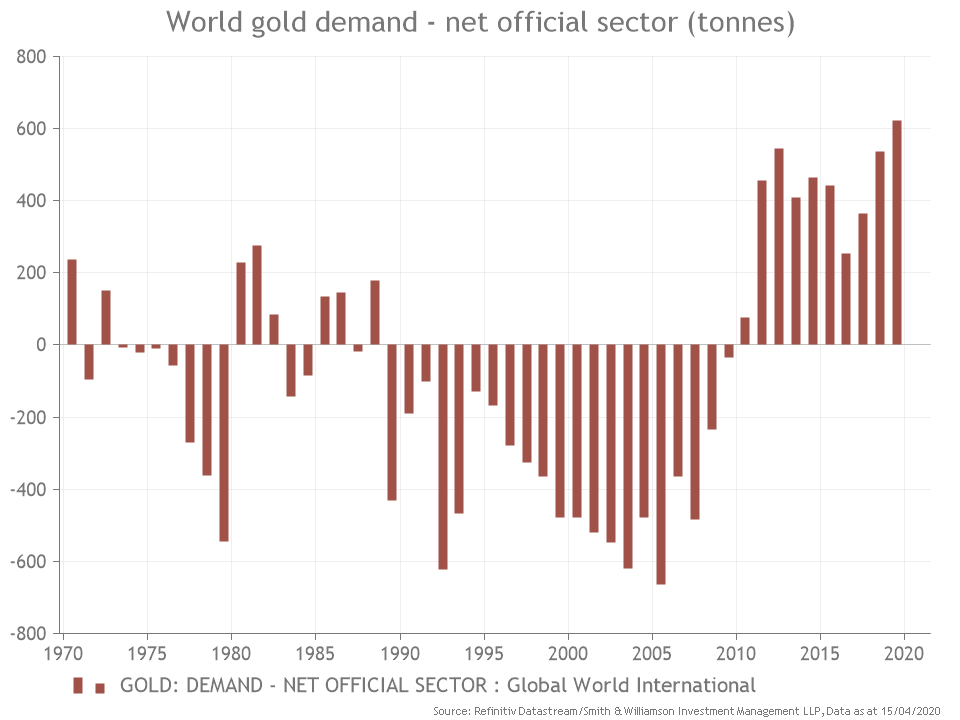

One of the main sources of demand for gold in the last 18 months has come from central banks (see chart 4) and the private/institutional investor still has a relatively low exposure given earlier comments, which should be supportive to demand going forward.

Chart 4: Gold demand is on an upward trend

Source: Refinitiv Datastream, calculations by S&W Investment Strategy, as at 15 April 2020

Finally, having focussed on the commodity and the demand side it would be remiss not to comment on the gold mining companies themselves (the supply side). It is a sector that has not enhanced its reputation for good allocation of capital in the last decade and this has been more than fairly reflected in valuations. However, we have been through a period of consolidation in the major gold companies (for example Barrick acquiring Randgold in 2018) and costs have been managed down to more sustainable levels (helped by a low oil price which is one of the main variable costs) at a time when the commodity price is rising, which should offer some excellent operational leverage for these businesses. Management teams have curtailed capital expenditure and balance sheets are more conservative, with a focus on ‘brown field’ development rather than speculative ‘green field’ exploration. In addition, this this will keep supply relatively tight in the medium term. Capital discipline should enhance cash flows and the credentials for improved pay-out ratios to shareholders who have long demanded such a change.

It is our view that in this environment portfolios should benefit from exposure to a combination of both gold and the underlying equities. This offers some protection within the defensive element of the portfolio and gives the potential to re-invest into risk assets (such as equities) in the future, whilst the underlying gold equities offer leverage to a rising gold price and a potentially attractive source of income.

Source: All datapoints quoted from Bloomberg, data as at 14 April 2020

DISCLAIMER

By necessity, this briefing can only provide a short overview and it is essential to seek professional advice before applying the contents of this article. This briefing does not constitute advice nor a recommendation relating to the acquisition or disposal of investments. No responsibility can be taken for any loss arising from action taken or refrained from on the basis of this publication. Details correct at time of writing.

Please remember investment involves risk. The value of investments and the income from them can fall as well as rise and investors may not receive back the original amount invested. Past performance is not a guide to future performance.

Evelyn Partners Investment Management LLP

Authorised and regulated by the Financial Conduct Authority.

Registered in England No. OC 369632. FRN: 580531

Evelyn Partners Investment Management LLP is part of the Evelyn Partners group.

© Evelyn Partners Group Limited 2021

Ref: 55520lw

Disclaimer

This article was previously published prior to the launch of Evelyn Partners.