A look back over macroeconomic and market events for the fortnight ending 21 April 1017. France heads to a run-off election, and the UK announces a snap General Election. There are signs of the consumer starting to roll over in the UK, and the US also appears to be cooling. Monetary policy meetings in Japan and Europe will be closely watched this week.

The UK announces a snap General Election

There was plenty of news out of the UK, with the announcement of a snap General Election in June (which we wrote about here) coming alongside the latest upgrades to the growth outlook from the International Monetary Fund (IMF).

The IMF is the latest group to reverse its fairly dire economic predictions made in the wake of the EU referendum, raising their 2017 growth forecast by 0.5% to 2.0%, and their 2018 forecast up 0.1% to 1.5%. However, a lot of the economic strength in the second half of the year came from a particularly buoyant consumer sector, and there are signs that this particular party could be coming to an end.

Retail sales growth in March fell far short of expectations, growing at just 1.7% year on year (yoy) from 3.7% in February (3.4% had been expected). This comes as price inflation has started to come through to retailing, with higher fuel and food prices impacting purchasing patterns. Indeed, the actual value spent is 5.1% higher than this time a year ago, and online sales are up 19.5% yoy by value. Excluding fuel, UK retail sales grew at 2.6% yoy (from 4.1%, with 3.9% expected).

This was echoed in the inflation figures released just before Easter, where headline inflation rose 2.3% yoy (unchanged from February and in line with expectations) whilst the core measure, which we have highlighted before as potentially being more relevant to our investment strategy, grew at 1.8%, down from 2.0% in February and a fall further than the 1.9% expected.

The US is cooling off

US economic data also showed signs of cooling. Headline inflation dipped from 2.7% to 2.4% yoy in March (2.6% was forecast) as a number of transitory effects moved out of the data, whilst core inflation fell from 2.2% to 2.0%, against forecasts of an increase to 2.3%.

Retail sales also disappointed, down -0.2% month on month (mom) from -0.3% in February (forecast was for -0.1%). The figure was dragged down by further disappointment in auto sales, which has been the focus of debate recently amid concerns over financing arrangements. Excluding autos, retail sales were flat (the same as last month, against estimates of 0.1% growth). Whilst overall these data are disappointing, it should be noted that the timing of Easter could be impacting these results, so we will watch developments in subsequent months closely.

Looking towards industrial activity, there was a positive reading for industrial production, which increased 1.5% in March from the same period last year, an acceleration from February’s 0.3% print. However the Purchasing Managers Index (PMI) survey data showed a slight deterioration, against expectations for a slight improvement. Manufacturing PMI fell from 53.3 to 52.8 (53.5 expected) and Services PMI fell from 52.8 to 52.5 (53.0 expected).

The fortnight’s other events

- France’s first round of presidential elections saw the centrist Emmanuel Macron and the far-right Marine Le Pen through to the second round, which takes place on Sunday 2 May. This was the base case for many analysts, but markets were relieved that a Mélenchon/Le Pen run-off – a choice between far-left and far-right candidates – was avoided. Macron has consistently been the favourite to win a run-off, though recent experience reminds us to never be too complacent when it comes to politics.

- Eurozone industrial production grew at 1.2% yoy in February, up from a revised 0.2% but short of the 2.0% expected. Survey data from the ZEW business surveys showed economic sentiment ticking up from 25.6 to 26.3 (25.0 was forecast).

- China’s official GDP rate for Q1 was reported as 6.9% yoy, slightly ahead of the forecast for no change at 6.8%. Reported economic data were also fairly robust, with industrial production accelerating from 6.3% to 7.6% yoy in March, retail sales accelerating to 10.9% yoy (from 9.6%) and fixed asset investment at 9.2% yoy (from 8.9%). The headline inflation rate increased 0.1% to 0.9%, though this was below the 1.0% expected. The Producer Price Index continued its strong recovery, growing 7.6% yoy in line with expectations, but slightly lower than the 7.8% reported previously.

The markets

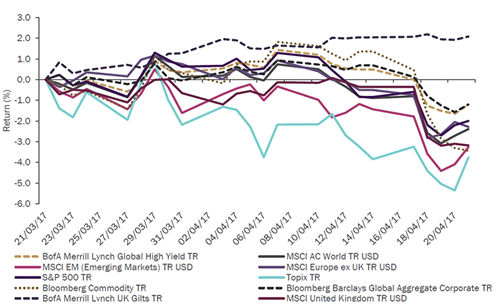

UK equities were down on the fortnight following the surprising snap election announcement, which also caused sterling to rally. Bond yields remain tight, and gold rallied.

Equities – UK equities fell sharply following the announcement of the snap General Election with the MSCI United Kingdom index falling -2.4%, primarily from large-cap names. This was in contrast to other major markets which were all down by less than a percentage point. In the US, the S&P 500 slipped -0.3%, and the MSCI Europe (excluding the UK) was down -0.9%. Japan’s TOPIX returned -0.1% whilst the Hang Seng index in Hong Kong slipped -0.9%.

Bonds – government bond yields remain tight, with UK 10-year gilt yields finishing the week at 1.04%, whilst the equivalent US Treasuries were yielding 2.25% and 10-year German bunds were yielding 0.25%.

Commodities – oil has continued to weaken over the last two weeks, driven lower by concerns over US inventory levels and reduction compliance from OPEC. Brent Crude ended the week at US$51.96 per barrel. Gold was stronger over the period, potentially driven by geopolitical concerns, to finish at US$1,287.40 per ounce, whilst copper was somewhat weaker at US$2.54 per lb.

Currencies – sterling rallied significantly on the announcement of a snap General Election, finishing the week at US$1.28, €1.19 and ¥140.

The week ahead

A reasonable amount of data is scheduled for release this week. Thursday is a busy day – both the Bank of Japan (BoJ) and the European Central Bank (ECB) conclude their monetary policy meetings, with the BoJ also releasing its quarterly outlook report. This is followed in the afternoon by US durable goods orders, which are expected to slow from 1.7% to 1.2% mom. Friday is also a busy day, with a range of Japanese data due out (details below) as well as Eurozone inflation (expected to have increased from 1.5% to 1.8% after the anomalous previous reading) and US GDP for the first quarter (forecast to have slowed from 2.1% to 1.1% annualised). On the political front, the US also has until the end of the week to come to budgetary agreement in order to avoid a government shutdown. Elsewhere:

On Monday the German IFO business survey results are released in the morning, followed by UK business optimism and industrial trends from the Confederation of British Industry. In the afternoon, the Chicago Fed National Activity index and Dallas Fed manufacturing index readings are out. On Tuesday US house prices and consumer confidence measures are the main data points to watch out for.

We have a quiet day mid-week ahead of a busy end to the week. US oil stocks out in the afternoon could be of interest. Mixed in with the BoJ and ECB announcements on Thursday, UK house prices are leased, as well as Eurozone business confidence and economic sentiment. In the afternoon, as well as US durable goods, wholesale inventories and the Kansas Fed manufacturing index could also attract some attention.

Friday starts with a bit of a data dump out of Japan, which includes inflation, household spending, unemployment and industrial production. Also early in the morning, the UK consumer confidence reading from Gfk is reported. Later in the morning, Eurozone inflation is updated, forecast to have increased from 1.5% to 1.8% yoy. In the afternoon, the US GDP numbers will also be accompanied by employment cost and quarterly inflation data.

Disclaimer

This article was previously published on Tilney prior to the launch of Evelyn Partners.