Inflation has notably decelerated in response to the COVID-19 induced recession we are currently experiencing. However, over the medium term, we see scope for a revival in consumer prices, a topic we have discussed previously. This is due to the combination of monetary and fiscal policy, with fiscal policy especially, playing a significant role. This risk needs to be reflected in a multi-asset portfolio.

Inflation risk is the erosion of the real purchasing power of money due to an increase in the price of goods and services. For example, £100,000 held in cash from May 2010 to May 2020 would have left a real value of £76,5231. Thus, as an acute risk to investors and savers, portfolios must account for the inflationary outlook. In particular, inflation is more of a risk to bond and cash positions than equity holdings.

Nevertheless, bonds can play a role in protecting a multi-asset portfolio from inflation risk, specifically US Treasury Inflation Protected Securities (TIPS). TIPS can also be used a volatility hedge, but from a purely inflationary perspective, they are preferable to UK-Linkers (the UK inflation linked equivalent) due to their attractive valuations and linkers’ correlation to sterling.

Sliding Inflation

The pervasive reach of COVID-19 has dampened price pressure in recent months as demand has slumped. Our analysis of core inflation excluding food and energy in developed markets has shown a clear decline in the rate of inflation compared to three months ago. Only Norway has shown a clear decline in the rate of inflation, while Canada has seen an almost 1% decrease2. Switzerland is experiencing deflation (a reduction of the general level of prices in an economy) and there is the possibility of this appearing elsewhere.

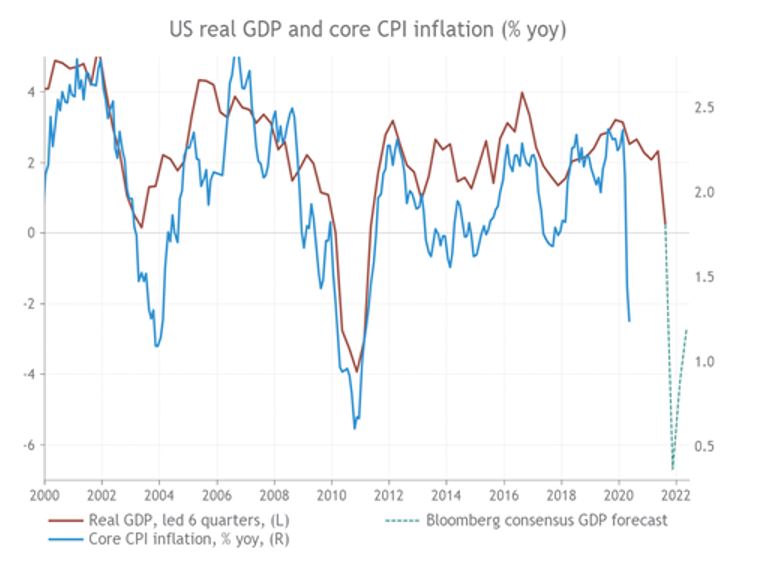

However, as economies begin to reopen, which increases consumption and GDP, we could see consumer prices recover over the medium term. As chart 1 shows, there is a strong correlation between US real GDP and core CPI inflation in both up and down stages of the economic cycle.

Chart 1: An easing of lockdown could revive consumer prices over the medium term

Source: Refinitiv Datastream/Smith & Williamson Investment Management LLP, Data as at 22/06/2020

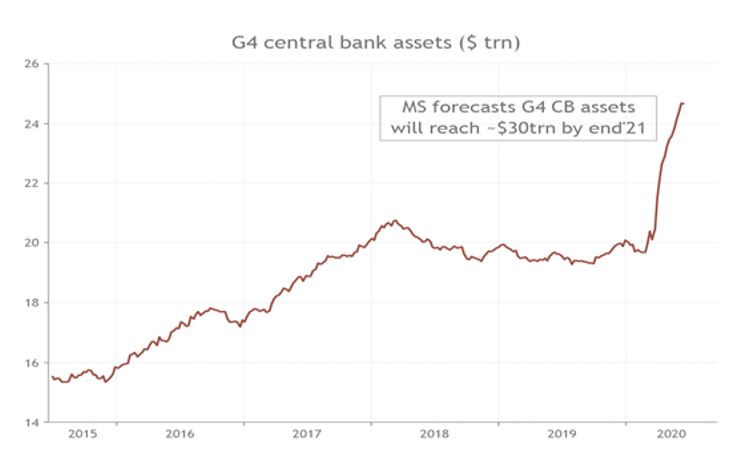

Importantly, this recovery in inflation and GDP is likely to be compounded and hastened by monetary and fiscal policy. Government responses to COVID-19 have been unrelenting. As chart 2 shows, G4 central bank assets, a measure of global liquidity, have spiked upwards as they seek to into increase money supply by buying a variety of assets and extending loans to banks. One forecast suggests that assets held by the G4 central banks will reach $30trn by the end of 20213.

Chart 2: A recovery in prices could be hastened by extremely easy monetary policy

Source: Refinitiv Datastream/Smith & Williamson Investment Management LLP, Data as at 22/06/2020

Fiscal response

Responses have been equally as impressive from a fiscal perspective. Various fiscal packages offering grants and loans have been put forward across the world. Currently, G4 countries + China have a combined headline general government fiscal balance of –16.9% of GDP. In comparison, this was –10.2% in 2009 after the Global Financial Crisis4.

The crucial element of this fiscal support is not necessarily the size, but the point of injection. Cash is being given straight to individuals, as opposed to securing the financial sector, an important difference from GFC. As money supply is increased and fiscal support remains strong, the conditions for a faster inflation improve. It is the magnitude of these stimuli working in conjunction with the easing of lockdowns that we see as crucial to higher inflation in the mid-term.

Portfolio implications

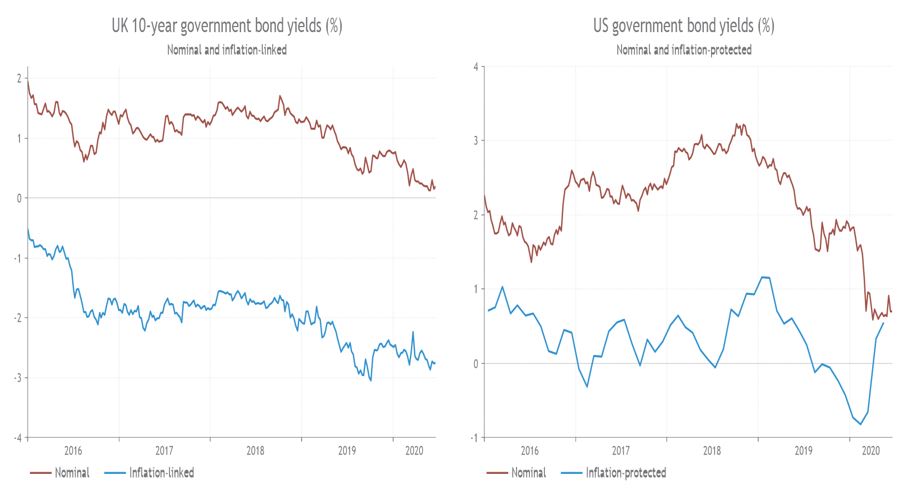

In order to protect multi-asset portfolios against inflationary pressures, we view inflation linked government bonds as the best option. Currently, we favour US TIPS (Treasury Inflation Protected Securities) over UK-Linkers. They look more attractive on valuation grounds. One means to judge the relative value offered by inflation-linked bonds is the ‘breakeven inflation rate’: the expected rate of inflation based on the difference between nominal and inflation linked bond yields: what does inflation need to average during the life of the bond for the returns to be the same, or ‘breakeven’? As chart 3 demonstrates, US TIPS are yielding far closer to their nominal counter parts, compared to the UK 10-year government bonds. This means a far lower rate of inflation is required for TIPS to match nominal US government bond yields, which gives greater scope for outperformance. Consequently, as we see positive inflation in the mid-term, TIPS present themselves as better value.

Chart 3: US inflation protected government bonds looks attractive on valuation grounds

Source: Refinitiv Datastream/Smith & Williamson Investment Management LLP, Data as at 22/06/2020

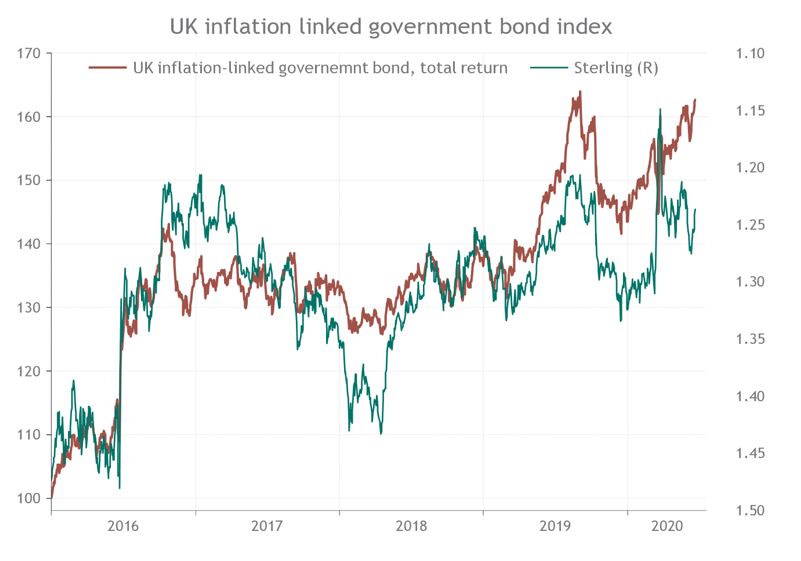

The second reason we prefer TIPS lies in the correlation of UK inflation-linked bonds to Sterling. Chart 4 displays this correlation, showing that as sterling weakens, the total return of UK linkers increases. When sterling depreciates, imports become increasingly expensive which in turn, increases inflation. Since the Brexit referendum, sterling has continually weakened, with the expected ‘Boris bounce’ having a short-lived impact. However, from these low levels there is the distinct possibility of a sterling rally. As the cogs of the UK economic start up, foreign investment may find its way back into the UK. Equally, while any clarity regarding the UK’s future trading relationship with the EU could also prompt a rebound. Given the correlation between linkers and sterling, we see UK linkers as susceptible to this potential sterling rally, further decreasing their attractiveness relative to US TIPS.

Chart 4: UK inflation-linked bonds are susceptible to a sterling rally

Source: Refinitiv Datastream/Smith & Williamson Investment Management LLP, Data as at 22/06/2020

Cutting past the short-term noise, our inflationary outlook in the medium term is positive. Easing lockdowns pave the way for GDP recovery, bolstered by historic levels of monetary and fiscal stimulus. We view US TIPS as the most attractive option to protect multi-asset portfolios in this new environment.

Sources:

- ONS RPI All Items Index, Smith & Williamson Investment Management, as at 22nd June 2020

- Bloomberg, Smith & Williamson Investment Management, as at 22nd June 2020

- Morgan Stanley, Smith & Williamson Investment Management, as at 22nd June 2020

- Hever Analytics, CEIC, IMF, Morgan Stanley Research forecasts, as at 14th June 2020

DISCLAIMER

By necessity, this briefing can only provide a short overview and it is essential to seek professional advice before applying the contents of this article. This briefing does not constitute advice nor a recommendation relating to the acquisition or disposal of investments. No responsibility can be taken for any loss arising from action taken or refrained from on the basis of this publication. Details correct at time of writing.

Risk warning

Investment does involve risk. The value of investments and the income from them can go down as well as up. The investor may not receive back, in total, the original amount invested. Past performance is not a guide to future performance. Rates of tax are those prevailing at the time and are subject to change without notice. Clients should always seek appropriate advice from their financial adviser before committing funds for investment. When investments are made in overseas securities, movements in exchange rates may have an effect on the value of that investment. The effect may be favourable or unfavourable.

Evelyn Partners Investment Management LLP

Authorised and regulated by the Financial Conduct Authority.

Registered in England No. OC 369632. FRN: 580531

Evelyn Partners Investment Management LLP is part of the Evelyn Partners group.

© Evelyn Partners Group Limited 2021

Disclaimer

This article was previously published prior to the launch of Evelyn Partners.