What happened?

The Conservative party has secured a single-party majority in the House of Commons. Given how close the polls were leading into the election, this was something of a surprise as the structural biases of the UK electoral system have historically favoured Labour when polls are tight.

Two of the most notable swing factors were the sweeping victory of the SNP in Scotland, who moved from 6 to 56 seats, most of which were taken from Labour, and the catastrophic collapse of the Liberal Democrats whose vote share has fallen into single digits, falling behind UKIP.

Market reaction

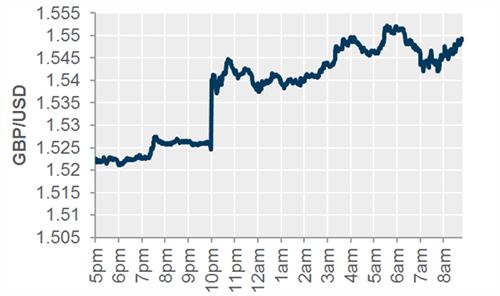

The initial market reaction has been relatively positive, which is most evident in the recovery of the sterling as shown in the chart below.

GBP/USD exchange rate 5pm 7/5/15 to 9am 8/5/15

Source: Factset

Markets were becoming increasingly wary of the political uncertainty surrounding an election which was generally expected to result in a hung parliament without an overall majority, putting pressure on the sterling. The subsequent relief rally started with a surge as the exit polls, released at 10pm, suggested a more decisive win for a single party. This was followed by continued strengthening of the currency through the night as a return to the stability of a traditional single-party majority became increasingly likely.

Our outlook

Despite the initial relief rally it doesn’t look like plain sailing from here, and even ahead of the election we were concerned that there was no ‘great’ outcome from an investment point of view.

Our primary concern now is the Conservative pledge for a referendum on EU membership in 2017. We don’t take a political stance on this issue, but a major risk is the perception of businesses and markets on such a referendum. The UK is the second largest economy for inward Foreign Direct Investment (there is just short of £1 trillion FDI in the UK according to the Office for National Statistics), a lot of which is business investment from overseas countries, which is a boost for the UK economy.

Yet again, the theme is uncertainty. While it is unclear whether or not the UK will remain in the world’s most powerful trading block, there is a risk that these overseas businesses could hold back investment until there is greater clarity. At some point following the immediate electoral aftermath we expect the markets to start focusing more intently on this issue.

Touching briefly on tax legislation, it seems unlikely the new Conservative government will feel the need for an emergency budget. This means we do not expect any changes to tax law until the Autumn Statement, which normally takes place in the first week of December. In the meantime, we will be studying the Conservative manifesto in detail to consider what impact the proposals may have. For example, it is widely thought that the rate of tax relief on pension contributions may be restricted for those earning over £150,000 per year.

In closing, I would highlight that although the UK election is very newsworthy, it is unlikely to be the major driver of investment returns for most portfolios. For globally diversified portfolios (directly or indirectly through UK companies with international exposure), we continue to concentrate on the global macroeconomic landscape – issues such as money printing in Europe and Japan, and the outlook for interest rates in the US and UK. We consider both of these to be more important factors from an investment point of view.

Disclaimer

This article was previously published on Tilney prior to the launch of Evelyn Partners.