In stark contrast to the European Central Bank (ECB) action a couple of weeks ago, the US Federal Reserve (the Fed) delivered exactly what was expected after weeks of deliberate signalling to the market to carefully manage expectations. The initial market reaction was understandably muted, though equity markets did rally somewhat through the course of the press conference. What is clear is that we are now exiting an era of exceptionally loose US monetary policy. Below we dissect both what the Fed did, but also what it could mean for markets and economies.

What actually happened?

In the aftermath of the global financial crisis, interest rates were cut close to zero and a period of exceptionally loose and unconventional monetary policy began as Central banks attempted to get economies back on their feet. Now, the FOMC of the US Federal Reserve has begun the process of normalising policy, increasing interest rates by 0.25% which moves the range from 0-0.25% to 0.25-0.50%.

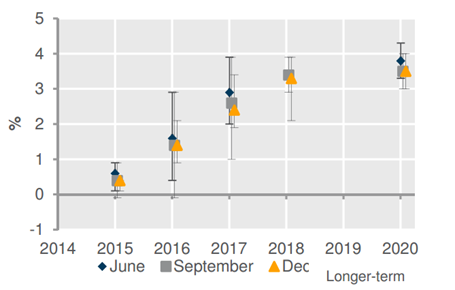

On its own, this rather limited move is unlikely to have a significant impact on fundamentals, but the effect on market psychology could be more significant. More importantly, it signals that we are now at the start of an interest rate hiking cycle, and the focus will now very much be on the path of interest rates from here on out, which is expected to be a very gradual rise. The chart below shows interest rate expectations from the FOMC members themselves and how they have changed since the summer.

PROJECTED US FEDERAL FUNDS RATE

Source: Federal Reserve. Symbols show median projections. Bars show full range of forecasts by FOMC members. Symbols offset for clarity. Note no June figure was supplied for 2018.

The messaging is very clear, with the ever-softening projections shown in the above chart as well as the rhetoric coming from FOMC members suggesting that this is unlikely to be a traditional rate hiking cycle. Indeed, the statement accompanying this hike explicitly states:

“The Committee expects that economic conditions will evolve in a manner that will warrant only gradual increases in the federal funds rate; the federal funds rate is likely to remain, for some time, below levels that are expected to prevail in the longer run”

You can’t get much clearer than that, and markets are pricing in a slow hiking cycle. But exactly how slow it will be, and whether it will turn out to be a policy error is still very much a live debate (spoiler alert: we think it is an error, and the FOMC has built itself a no-win scenario, but more on that below).

Why did they do it?

The FOMC has a dual mandate to achieve maximum employment and stable prices, which functionally means a strong labour market and inflation at around 2%. They consider this to be a healthy economy. When the economy appears to be flagging, the FOMC has historically provided support through loose monetary policy (low interest rates) to provide a tailwind before ‘normalising’ interest rates when the economy looks healthy, then potentially tightening policy if the economy looks like it’s overheating. The Fed also has to try to get somewhat ahead of the curve because the structure of the US economy means there tends to be a relatively long lead time for interest rate changes to have an effect.

The problem for the FOMC over the last couple of years was that the economy had been giving seriously mixed messages. Whilst GDP growth was fairly solid, labour market signals were incoherent – unemployment was falling, but participation rates were (and still are) low and wages weren’t picking up. Similarly, inflation has been very weak, but part of this has been driven by the strength of the dollar and external factors such as the collapse of the oil price.

Through much of this year the picture on employment and inflation has started to become clearer, giving the FOMC confidence that it could start taking interest rates off what were essentially emergency low rates. Many had expected rates to rise much earlier in the year, but a couple of wobbles in some of the economic data and temporary concerns around overseas markets and economies stayed the Committee’s hand. In the end, however, the FOMC’s focus is on the US economy, and there has been a clear drive by the Committee to increase rates. Arguably they feel the need for rates to be higher in order to have room to deal with a future downturn – they basically want to reload their monetary policy bazooka.

Our view

Unfortunately we believe that this will turn out to be a policy error, and that this action comes too late. Exceptionally loose monetary policy has been in place for too long, with excess liquidity driving asset price inflation and preventing a proper default cycle. Whilst history suggests there is nothing inherently market-unfriendly about interest rates normalising from an accommodative mode, this usually happens at a much earlier stage of the economic and market cycle, where it is taken as a sign of confidence.

As we stand now, the Fed’s economic view, focusing almost exclusively on employment and inflation, may appear to be in recovery, but to our mind the broader situation paints a different picture. GDP growth appears to be slowing, US corporate earnings in aggregate are falling and the same corporations are complaining about the harm a strong dollar is doing to their sales. Higher US rates could well put upward pressure on the US dollar, whilst higher wages and debt servicing costs are expected to put the squeeze on corporate margins. In fact credit markets haven’t waited for the Fed to actually move, and borrowing costs for US corporations have been moving steadily higher through the year. A knock-on effect of this could well be to disincentivise companies from pursuing debt-fuelled buy-backs, which has been a key driver of US equities prices over the last couple of years. Of course, there may be some beneficiaries – US banks may receive a boost as higher interest rates allow them to improve their net interest margins, but this is perhaps not what the Fed is hoping to achieve overall.

Pressure on US corporations is ultimately likely to feed back into the real economy as they respond to weak earnings by cutting back on capital expenditure and scaling back their payroll plans. The timing of this is difficult to judge, but from our point of view there is a clear path to an economic and market downturn from here.

In conclusion

Whilst this is a key symbolic and psychological point in time for markets and economies, it doesn’t materially change the fundamentals. Monetary policy is now seriously diverging across major economies, with tightening happening now in the US and expected in the UK, whilst the Eurozone is further loosening monetary policy and conditions in Japan are expected to remain very accommodative.

The US Federal Reserve has acted too late, and has probably built itself a no-win scenario – excessive global liquidity has allowed asset prices to inflate and has helped drive leverage across the Emerging Markets as well as in US corporations (partly to fund buy-backs).

In the portfolios we manage we continue to maintain a cautious stance, remaining underweight in Equities and Fixed Income, and favouring Alternatives and tactical positions in cash. Whilst we recognise growing challenges to the investment outlook, there do remain some areas of relative attraction. In particular, within an overall underweight in equities, we do prefer European equities – where the nascent recovery appears to be gaining traction and monetary policy remains supportive. As a result, we are overweight Europe within our equity exposure, at the expense of the US and Emerging Markets.

Disclaimer

This article was previously published on Tilney prior to the launch of Evelyn Partners.