At its December meeting, the Federal Open Market Committee (FOMC) shifted gear. It accelerated the pace at which it is tapering its quantitative easing programme. Asset purchases are now likely to end in March 2022 and expectations of interest rate rises have been brought forward. While this may be a small headwind for equity markets in the year ahead, strong economic fundamentals should continue to compensate for the removal of loose monetary policy.

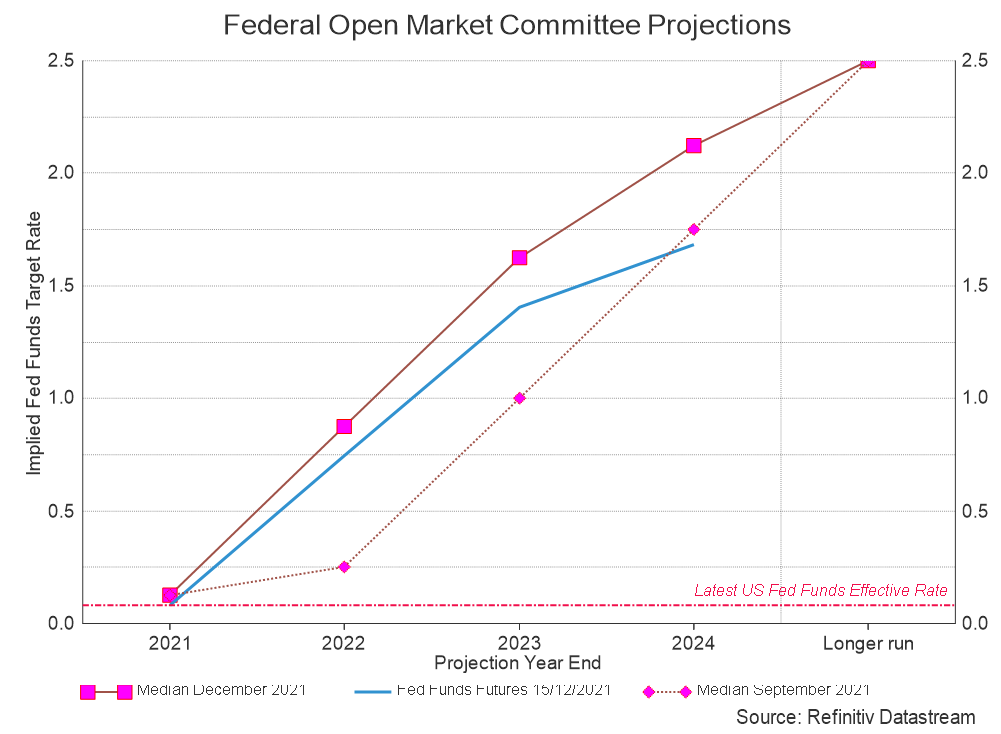

The FOMC blamed stronger inflation and employment data for its actions, saying it wanted the option to raise rates sooner. Tellingly, it dropped the word ‘transitory’ from its analysis of inflation and added that full employment is an important consideration before rate rise. All members of the committee see rates rising in 2022, with the median expectation for three quarter-point increases, bringing rates to around 1%.1

This acceleration is important in the face of mounting inflationary pressures: if the FOMC had not acted to accelerate rate hike projections, investors may have become concerned that the central bank was making a policy mistake over inflation. The fear would be that it would have to raise rates by more than the market currently expects down the road. Rising US inflation could condition US consumers to expect higher rates.

As we see it, the FOMC has been balanced in its tone and sensible in its actions. Its interest rate projections are broadly in line with the Fed futures market over the next few years and this move is unlikely to unnerve the bond market.

Strong fundamentals

The biggest question for investors is whether this small tightening of monetary policy hastens a reversal in the strong economic growth the US has enjoyed over the past 12 months. The Fed is raising interest rates against a backdrop of solid economic growth. The evidence probably suggests that the US economy is firmly in the middle stages of the business cycle, even if there is debate over the details. Recession appears a long way off, and these moderate monetary policy shifts will take time to filter through to the real economy.

Against this backdrop, it is unlikely that Fed tightening will lead to a sharp decline in growth in 2022. Deutsche Bank research finds that from 13 different Fed hiking periods since 1955 it takes an average of 3½ years before the US falls into recession.2 On this basis, assuming the Fed raises rates in H1 2022, a recession would not be due until late 2025.

The same research shows that real GDP growth in the first year of a hiking cycle averages +4.8%. This slowed to +2.7% in the second year, and +2.1% in the third year.2 While there are outliers – the earliest point at which a recession has materialised is 11 months – we would suggest that a reversal in growth is unlikely to materialise this year.

Has the Fed done enough?

The flipside of this question is whether the Fed has done enough to contain inflation. Given that the Fed only started to remove accommodative policy by reducing quantitative easing a few months back, that seems unlikely. Moreover, the latest data is concerning. US CPI inflation in November rose 6.8% from a year ago, its highest level since the Volcker era in 1982 and continues to run ahead of expectations.3 Should there be another leg-up in inflation – perhaps because wage inflation becomes entrenched - it could lead to a hastier removal of policy support that brings forward recession risk to markets. For the time being, we see this as an outside risk. However, on the positive side, at least the Fed is indicating it will raise interest rates next year to address potential overheating without disrupting the economic recovery when there is plenty of uncertainty over Covid-19.

What does that mean for stock markets?

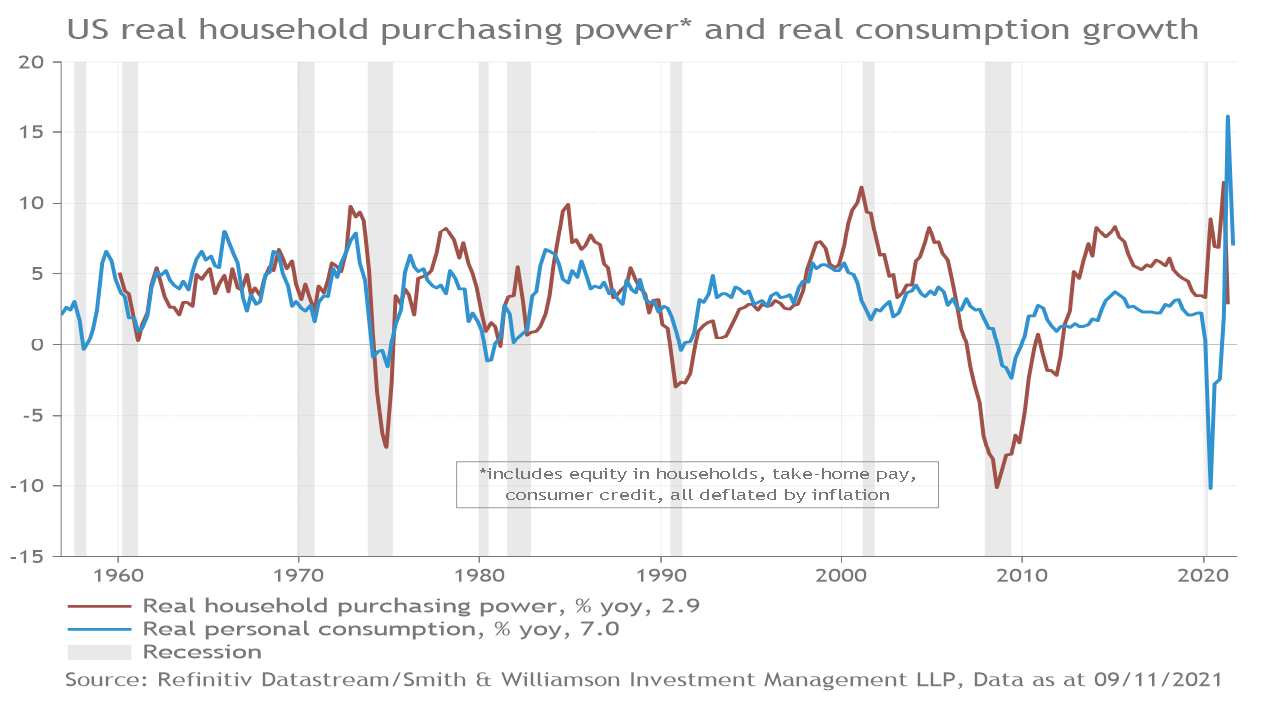

The MSCI All Country World equity benchmark total returns are up nearly 70% in GBP terms since its low in March 2020.4 This impressive rebound has left investors understandably worried that the market has recovered too quickly too soon. While there are concerns that once the Fed reduces accommodative policy it could siphon liquidity out of the market and lead to a sell off, the fundamental outlook still looks strong. Private consumption, the driving force for the GDP expansion and company earnings, is underpinned by healthy finances. For instance, after falling $6trn in the first quarter of 2020 during the start of the pandemic, US aggregate household net worth has since recovered a cumulative $34trn up to the third quarter of 2021 on the back of rising asset prices.5 Putting together financial resources available to consumers from housing wealth, take-home pay (income after tax is deducted) and consumer credit, this measure of US real consumer purchasing power rose at a relatively healthy annual rate of 6.7% in the third quarter of 2021.

The favourable economic backdrop should mitigate the risk to stocks from the Fed reducing accommodative policy. Some value-orientated sectors may even benefit from the Fed’s actions. Stronger growth and an expected steepening in the yield curve should be beneficial for bank earnings, for example.

This appears to be a prudent decision from the Federal Reserve, giving it the wherewithal to tackle inflation, while not over-reacting to pressures that may start to ebb in 2022. The fundamentals for the US economy are still strong, and some small weakening in consumer spending should not disrupt that. This benign backdrop should continue to support stock markets in the year ahead.

Sources:

1,3,4,5 Refinitiv, Smith & Williamson, data as at 20 December 2021

2 Deutsche Bank, When the Fed hikes: what happens next? 13 December 2021

Ref: 21128400

DISCLAIMER

By necessity, this briefing can only provide a short overview and it is essential to seek professional advice before applying the contents of this article. This briefing does not constitute advice nor a recommendation relating to the acquisition or disposal of investments. No responsibility can be taken for any loss arising from action taken or refrained from on the basis of this publication. Details correct at time of writing.

Please remember investment involves risk. The value of investments and the income from them can fall as well as rise and investors may not receive back the original amount invested. Past performance is not a guide to future performance.

Evelyn Partners Investment Management LLP

Authorised and regulated by the Financial Conduct Authority.

Registered in England No. OC 369632. FRN: 580531

Evelyn Partners Investment Management LLP is part of the Evelyn Partners group.

© Evelyn Partners Group Limited 2021

Disclaimer

This article was previously published prior to the launch of Evelyn Partners.