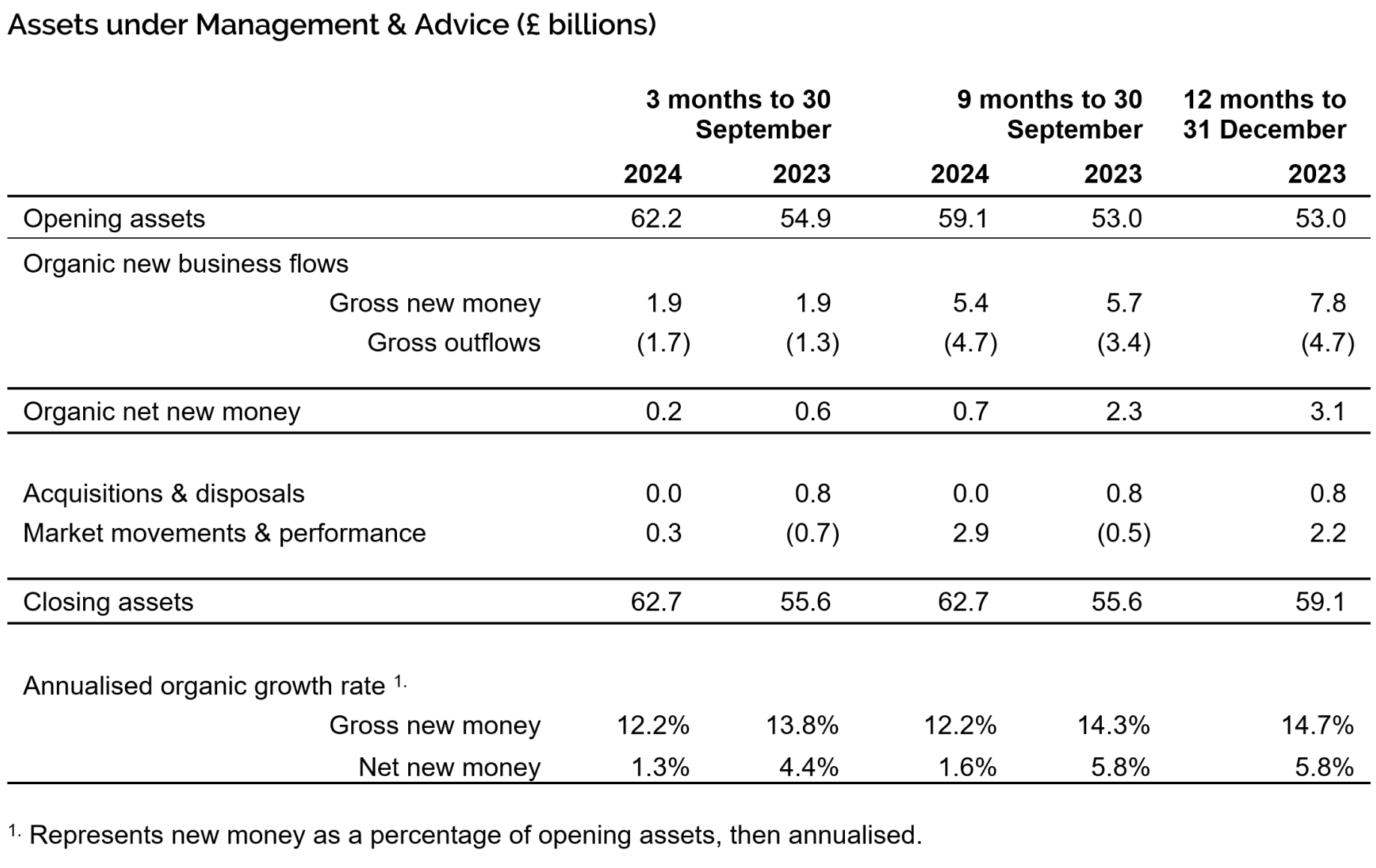

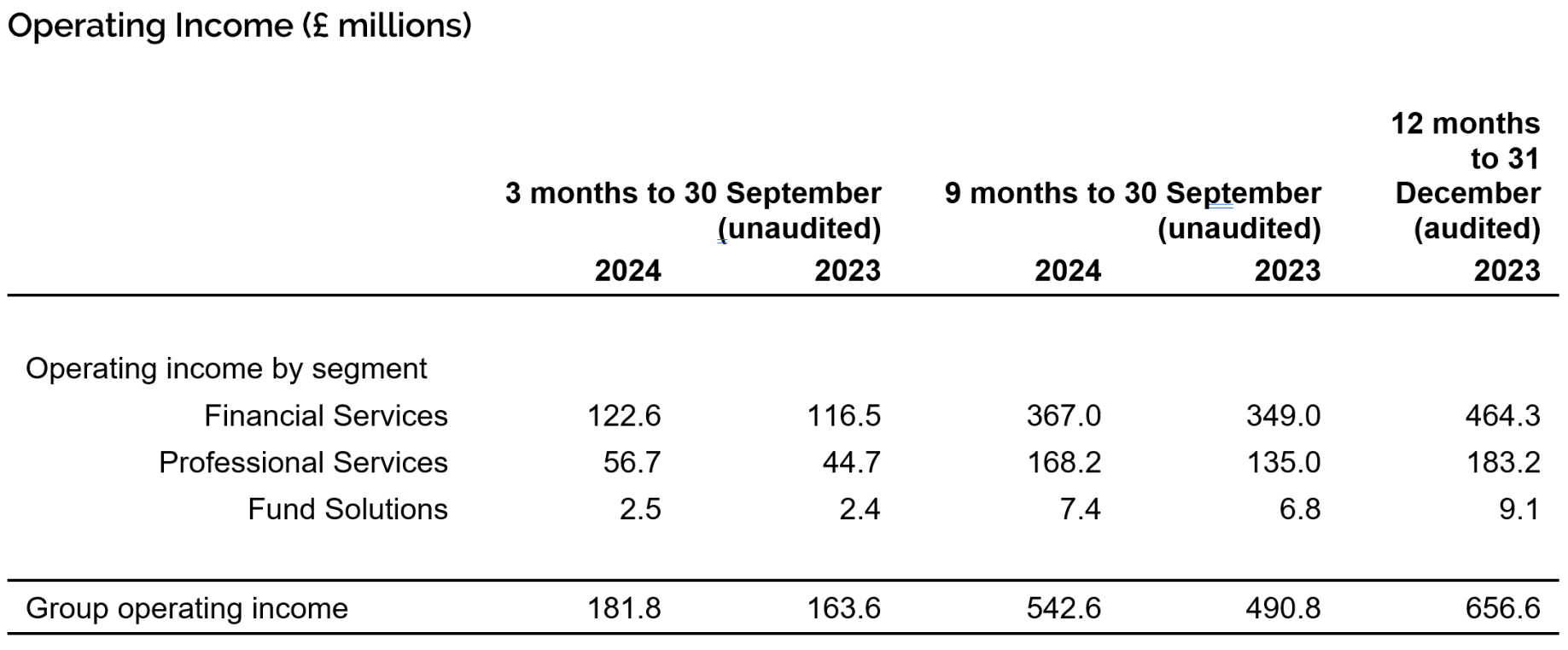

Evelyn Partners was created in 2020 through the merger of Tilney and Smith & Williamson. With £63.0 billion of assets under management (as at 31 December 2024), we are one of the largest UK wealth managers ranked by client assets.

Through an extensive network of offices across 25 towns and cities in the UK, as well as the Republic of Ireland and the Channel Islands, we support private clients, family trusts and charities, as well as provide investment solutions to financial intermediaries. Our diverse client base includes entrepreneurs, C-suite senior managers and partners of professional firms.

Our expertise span both award-winning financial planning and investment management, enabling us to offer clients a truly holistic dual expert wealth management service. Through Bestinvest, we also provide an online investment platform and coaching service, for self-directed investors, consistent with our purpose of ‘placing the power of good advice into more hands’.